UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

PDS Biotechnology Corporation |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | ||||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

(1) | Title of each class of securities to which transaction applies: | ||||

(2) | Aggregate number of securities to which transaction applies: | ||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||

(4) | Proposed maximum aggregate value of transaction: | ||||

(5) | Total fee paid: | ||||

o | Fee paid previously with preliminary materials. | ||||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

(1) | Amount Previously Paid: | ||||

(2) | Form, Schedule or Registration Statement No.: | ||||

(3) | Filing Party: | ||||

(4) | Date Filed: | ||||

PDS Biotechnology Corporation

300 Connell Drive

Suite 4000

Berkeley Heights, NJ 07922

To Be Held On

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Edge Therapeutics, Inc.,PDS Biotechnology Corporation, a Delaware corporation. The Annual Meeting will be held on Tuesday, June 19, 2018September 24, 2019 at 9:009 a.m. local time at the headquartersoffices of Edge Therapeutics, Inc. at 300 Connell Drive,DLA Piper LLP (US), 51 John F Kennedy Parkway, Suite 4000, Berkeley Heights, NJ 07922120, Short Hills, New Jersey 07078 for the following purposes:

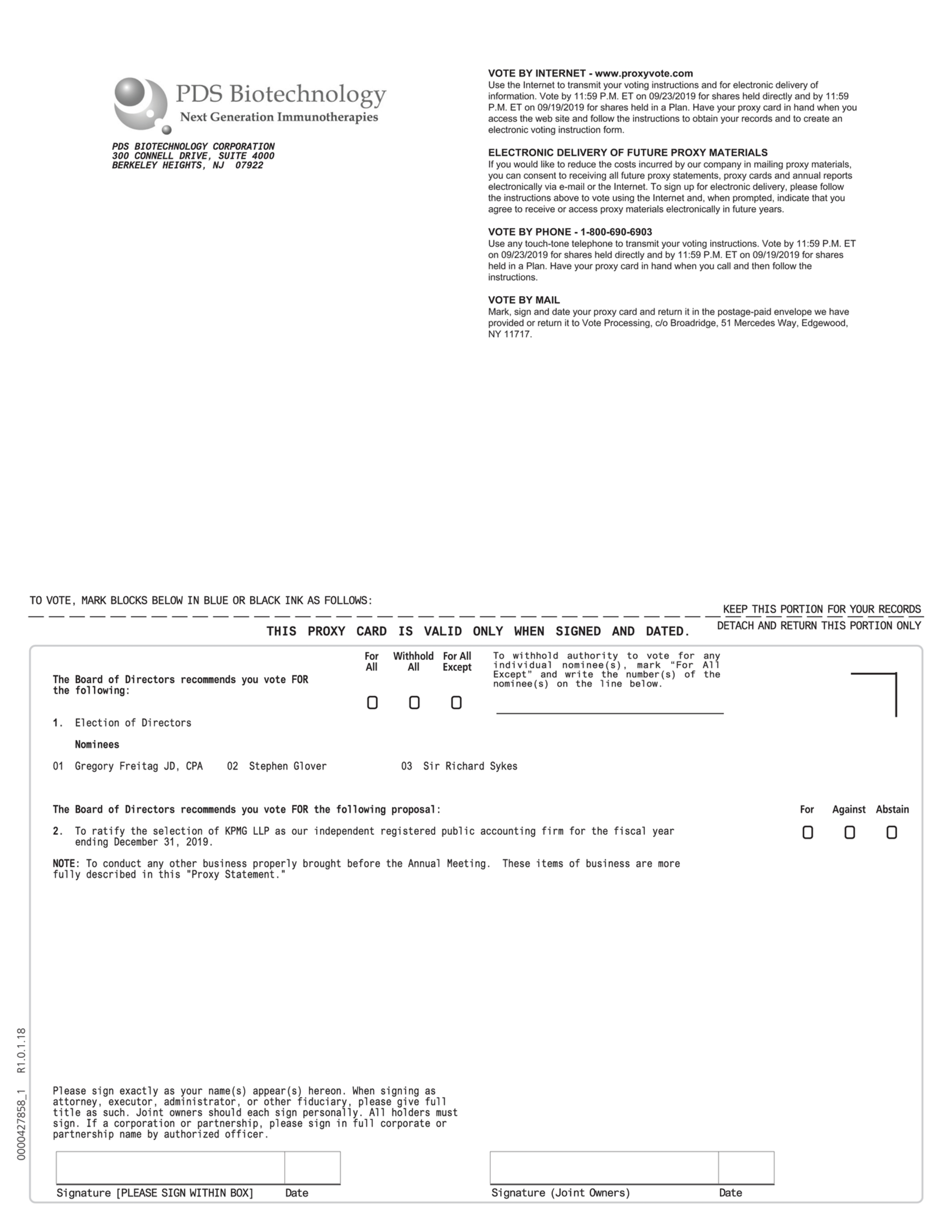

| 1. | To elect three Class A directors of the |

| 2. | To ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

| 3. | To conduct any other business properly brought before the Annual Meeting. These items of business are more fully described in this “Proxy Statement.” |

These items of business are more fully described in the proxy statement accompanying this notice. Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

The record date for the Annual Meeting was April 23, 2018is August 13, 2019 (the “Record Date”). Only stockholders of record at the close of business on that date may vote at the Annual Meeting or any adjournment thereof.

This notice of annual meeting, proxy statement, and accompanying form of proxy card, dated as of August 16, 2019 are filed and are being made publicly available on August 16, 2019, and will be mailed to you on or about August 23, 2019.

By Order of the Board of Directors

Chief Financial Officer

Berkeley Heights, New Jersey

You are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, please complete, date, sign and return the proxy card, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the Annual Meeting. Even if you have voted by proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder. |

PDS Biotechnology Corporation

300 Connell Drive

Suite 4000

Berkeley Heights, NJ 07922

PROXY STATEMENT

FOR THE

QUESTIONS AND ANSWERS ABOUT PROCEDURAL MATTERS

Why didam I receive areceiving these proxy materials?

Our board of directors is providing these proxy materials to you in connection with the solicitation of proxies for use at the Annual Meeting to be held on Tuesday, September 24, 2019 at 9 a.m. local time, and at any adjournment or postponement thereof, for the purpose of considering and acting upon the matters set forth herein. We intend to mail the notice regarding the availabilityof Annual Meeting, this proxy statement, accompanying form of proxy materialscard, and our 2018 Annual Report to Stockholders to you on the internet?

What is included in the proxy materials?

The proxy materials overinclude:

How do I attend the Annual Meeting?

The Annual Meeting will be held on Tuesday, June 19, 2018September 24, 2019 at 9:009 a.m. local time at the headquartersoffices of Edge Therapeutics, Inc. at 300 Connell Drive,DLA Piper LLP (US), 51 John F Kennedy Parkway Suite 4000, Berkeley Heights, NJ 07922.120, Short Hills, New Jersey 07078. Information on how to vote in person at the Annual Meeting is discussed below.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. On this Record Date, there were 31,246,2315,278,850 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on the Record Date your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

1

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If on the Record Date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote:

Proposal 1:

Election ofProposal 2:

Ratification of the selection by the Board of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31,What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

For the proposal to elect Dr. BarerGregory Freitag, Stephen Glover and Mr. LeuthnerSir Richard Sykes to the Board, you may either vote “For” or you may “Withhold” your vote, in each case, for all, some or none of the Board’s nominees. For the proposal to ratify the selection of KPMG LLP, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy over the telephone, vote by proxy through the internet, or vote by proxy using a proxy card that you may request or that we may elect to deliver to you. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

| • | Via the Internet: To vote through the internet, go to www.proxyvote.com and follow the on-screen instructions. Your internet vote must be received by 11:59 p.m., Eastern Time on September 23, 2019 to be counted. |

2

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a notice containing voting instructions from that organization rather than from us. Simply follow the voting instructions in the notice to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of the Record Date.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or in person at the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

See “What are broker non-votes?” below.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, “For” the election of each of Dr. BarerGregory Freitag, Stephen Glover and Mr. LeuthnerSir Richard Sykes as directors and “For” the ratification of the selection of KPMG LLP as our independent registered public accounting firm. If any other matter is properly presented at the Annual Meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the reasonable cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting.

Stockholder of Record: Shares Registered in Your Name

If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

Your most current proxy card or telephone or internet proxy is the one that is counted.

3

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If your shares are held by your broker, bank or other agent as a nominee, you should follow the instructions provided by your broker, bank or other agent.

When are stockholder proposals and director nominations due for next year’s annual meeting?

Stockholder proposals, including a director nomination, to be considered for inclusion in the proxy statement for the 20192020 annual meeting of stockholders must be received by us no later than December 12, 2018.May 27, 2020. The proposal must comply with SEC regulations regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Upon receipt of any such proposal, we will determine whether or not to include such proposal in the proxy statement for the 20192020 annual meeting of stockholders and proxy in accordance with regulations governing the solicitation of proxies.

Stockholders who wish to submit a proposal that is not intended to be included in our annual meeting proxy statement but to be presented for consideration at next year’s annual meeting, or who propose to nominate a candidate for election as a director at that meeting, are required by our bylaws to provide notice of such proposal or nomination no later than the close of business on April 20, 2019,July 26, 2020, but no earlier than the close of business on March 21, 2019,June 26, 2020, to be considered for a vote at next year’s annual meeting.

Any proposal, nomination or notice must contain the information required by our bylaws and be delivered to our principal executive offices at Edge Therapeutics, Inc.,PDS Biotechnology Corporation, c/o Corporate Secretary, 300 Connell Drive, Suite 4000, Berkeley Heights, NJ 07922.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for the proposal to elect each of Dr. BarerGregory Freitag, Stephen Glover and Mr. Leuthner,Sir Richard Sykes, votes “For,” “Withhold” and broker non-votes; and, with respect to the proposal to ratify the selection of KPMG LLP, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will have the same effect as an “Against” vote for the proposal to ratify the selection of KPMG LLP. Because a director nominee is elected by the affirmative vote of the holders of a plurality of the shares of common stock voted, abstentions will have no effect on the vote for the proposal to elect each of Dr. BarerGregory Freitag, Stephen Glover and Mr. Leuthner.Sir Richard Sykes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

What are “broker non-votes?”

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of NASDAQ,Nasdaq, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested) and executive compensation, including the advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation.

How many votes are needed to approve each proposal?

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the Annual Meeting in person or represented by proxy. On the Record Date, there were 31,246,2315,278,850 shares outstanding and entitled to vote. Thus, the holders of 15,623,1162,639,425 shares must be present in person or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairman of the Annual Meeting or the holders of a majority of shares present at the Annual Meeting in person or represented by proxy may adjourn the Annual Meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Who can help answer your questions?

If you have questions about the Annual Meeting or would like additional copies of this Proxy Statement, you should contact our Secretary, W. Bradford Middlekauff,Andrew Saik at Edge Therapeutics, Inc.,PDS Biotechnology Corporation, 300 Connell Drive, Suite 4000, Berkeley Heights, NJ 07922.

5

EXPLANATORY NOTE

Prior to March 15, 2019, we were a clinical-stage biotechnology company known as Edge Therapeutics, Inc (“Edge”). On March 15, 2019, we completed our business combination with privately held PDS Biotechnology Corporation, a Delaware corporation (“Private PDS”), in accordance with the terms of an Agreement and Plan of Merger and Reorganization, dated as of November 23, 2018, as amended on January 24, 2019 (the “Merger Agreement”), that we entered into with Private PDS and Echos Merger Sub, Inc., a Delaware corporation and our wholly owned subsidiary (“Merger Sub”). Pursuant to the terms of the Merger Agreement, Merger Sub merged with and into Private PDS (the “Merger”), with Private PDS continuing as our wholly owned subsidiary and the surviving corporation of the Merger. At the closing of the Merger, we issued shares of our common stock to Private PDS stockholders based on an agreed upon exchange ratio, and each option or warrant to purchase Private PDS capital stock became an option or warrant, respectively, to purchase our common stock, subject to adjustment in accordance with the agreed upon exchange ratio. Following the closing of the Merger, approximately 82,792,437 pre-Reverse Stock Split shares of our common stock were issued or are issuable to Private PDS’s stockholders, warrantholders and optionholders, at an “emerging growth company”exchange rate of approximately 6.5240 pre-Reverse Stock Split shares of our common stock in exchange for each share of Private PDS capital stock outstanding immediately prior to the Merger, we effected a reverse stock split at a ratio of one new share for every twenty shares our common stock then-outstanding (the “Reverse Stock Split”), our name was changed to PDS Biotechnology Corporation, the name of Private PDS was changed to PDS Operating Corporation, the business of Private PDS became our business, and we became a clinical-stage biopharmaceutical company focused on developing multi-dimensional cancer immunotherapies that are designed to overcome the limitations of the current approaches. In connection with the closing of the Merger, our stock began trading on the Nasdaq Capital Market under applicable federal securities lawsthe symbol “PDSB” on March 18, 2019. Unless otherwise noted, all references to common stock share amounts and therefore permitted to take advantageprices per share of certain reduced public company reporting requirements. As an emerging growth company, we providecommon stock in this Proxy Statementproxy statement give effect to the scaled disclosure permitted underMerger and the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), includingReverse Stock Split. As used herein, the compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated underword “Edge” refers to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, as an emerging growth company, we are not requiredCompany prior to conduct votes seeking approval, on an advisory basis,the completion of the compensation ofMerger and the terms the “Company” and “PDS” refer to our named executive officers orcompany immediately following the frequency with which such votes must be conducted. We will remain an “emerging growth company” until the earliest of (i) the last daycompletion of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) December 31, 2020; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC.

6

Election of Directors

Our Board is divided into three classes: Class A, Class B and Class C, with each class serving a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors that may serve on the Board, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The Board presently has tenseven members. The twothree nominees for director this year are Sol Barer, Ph.D.Gregory Freitag, Stephen Glover and Brian Leuthner,Sir Richard Sykes, each of whom is a current director of Edge.PDS. If elected at the Annual Meeting, each of Dr. BarerMr. Freitag, Mr. Glover and Mr. LeuthnerSir Richard Sykes would serve until the 20212022 annual meeting and his successor has been duly elected and qualified, or his earlier death, resignation or removal. No director or nominee for director is related to any other director or executive officer of EdgePDS or nominee for director by blood, marriage or adoption. Our directors are expected to attend our Annual Meeting, either in person or telephonically. There are no arrangements or understandings between any nominee and any other person pursuant to which each such the nominee was selected.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. Accordingly, each of Dr. BarerMr. Freitag, Mr. Glover and Mr. LeuthnerSir Richard Sykes will be elected if he receives a plurality of the votes cast. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of each of Dr. BarerMr. Freitag, Mr. Glover and Sir Richard Sykes. If Mr. Leuthner. If Dr. BarerFreitag, Mr. Glover or Mr. LeuthnerSir Richard Sykes becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for such person will instead be voted for the election of a substitute nominee proposed by our Board. Dr. BarerMr. Freitag, Mr. Glover and Mr. LeuthnerSir Richard Sykes have each agreed to serve if elected. Our management has no reason to believe that either Dr. BarerMr. Freitag, Mr. Glover or Mr. LeuthnerSir Richard Sykes will be unable to serve.

The following table provides information on the nominees for the position of director of EdgePDS as of the Record Date and for each director continuing in office after the Annual Meeting.

Name | Age | ||

Nominees for Director | |||

(Class A − Term expiring at annual meeting of stockholders in 2022) | |||

Gregory Freitag, J.D., CPA | 60 | ||

Stephen Glover | 60 | ||

Sir Richard Sykes | 77 | ||

Directors Continuing in Office | |||

(Class B − Term expiring at annual meeting of stockholders in 2020) | |||

James J. Loughlin | 76 | ||

Andrew Saik | 50 | ||

(Class C − Term expiring at annual meeting of stockholders in 2021) | |||

Frank Bedu-Addo, Ph.D. | 54 | ||

De Lyle W. Bloomquist | 60 | ||

| Name | Age | Director Since | ||||||

| Nominees for Director | ||||||||

| (Class C − Term expiring at annual meeting of stockholders in 2021) | ||||||||

| Sol Barer, Ph.D. | 71 | 2011 | ||||||

| Brian A. Leuthner | 53 | 2009 | ||||||

| Directors Continuing in Office | ||||||||

| (Class A − Term expiring at annual meeting of stockholders in 2019) | ||||||||

| Kurt Conti | 55 | 2010 | ||||||

| Liam Ratcliffe, M.D., Ph.D. | 54 | 2016 | ||||||

| Robert Spiegel, M.D. | 69 | 2013 | ||||||

| (Class B − Term expiring at annual meeting of stockholders in 2020) | ||||||||

| Isaac Blech | 68 | 2013 | ||||||

| Rose Crane | 58 | 2017 | ||||||

| James Loughlin | 75 | 2011 | ||||||

| R. Loch Macdonald, M.D., Ph.D. | 56 | 2009 | ||||||

7

CLASS CA NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2021 2022 ANNUAL MEETING

Gregory Freitag J.D., CPA

Mr. Freitag has served on ourPDS’s board of directors since September 2011December 2014. Mr. Freitag currently serves as the General Counsel and has been Chairmana member of ourthe board of directors since January 2013. Heof Axogen, Inc. (NASDAQ: AXGN) and previously served as its Chief Financial Officer and Senior Vice President of Business Development. Axogen, Inc. is a leading regenerative medicine company dedicated to peripheral nerve repair. Mr. Freitag was Chief Executive Officer, Chief Financial Officer and a board member from June 2010 through September 2011 of LecTec Corporation, an intellectual property licensing and holding company that merged with Axogen in September 2011. Mr. Freitag is a principal of FreiMc, LLC, a health care and life science consulting and advisory firm he founded that provides strategic guidance and business development services. Prior to founding FreiMc, Mr. Freitag was a Director of Business Development at Pfizer Health Solutions, a former subsidiary of Pfizer, Inc. and worked for Guidant Corporation in their business development group. Prior to Guidant Corporation, Mr. Freitag was the Managing PartnerChief Executive Officer of SJ Barer Consulting. Dr. Barer spent 24 years at Celgene as, among other positions, President, COOHTS Biosystems, a biotechnology tools start-up company and CEO,was the Chief Operating Officer, Chief Financial Officer and General Counsel of Quantech, Ltd. Prior to Quantech, Mr. Freitag practiced corporate law in Minneapolis, Minnesota. Mr. Freitag is also a director of the Foundation Board of HealthEast Care System, a health care system in Minnesota. The board of directors believes that Mr. Freitag’s leadership, legal, corporate governance and accounting experiences and knowledge, as well as its Executive Chairmanhis familiarity with the life sciences industry and Chairman before retiringPDS, provide him with the qualifications and skills to serve as a director.

Stephen Glover

Mr. Glover joined PDS Biotech’s Board of Directors in June 2011. Dr. Barer currently serves asApril 2019 and is the Chairman of the Board of Teva Pharmaceutical Industries Ltd. (NYSE: TEVA)Directors. Mr. Glover is the Co-Founder and Managing Principal for Asclepius Life Sciences Fund, LP, and the Co-Founder, President and CEO of ZyVersa Therapeutics (formerly Variant Pharmaceuticals), Lead Independenta clinical-stage specialty biopharmaceutical company focused on developing drugs to treat inflammatory and renal diseases. Mr. Glover has extensive experience executing biopharmaceutical company turnarounds and growing top line revenues, with a focus on pharmaceutical business strategy corporate development, product development, commercialization and business optimization. His vast experience spans Fortune 100, start up and entrepreneurial environments and his transaction experience covers over 25 transactions totaling over $10 billion. His strategic and operational experience, which covers most therapeutic classes of biopharmaceuticals, includes strategic planning, corporate development, operations management, product development, clinical and regulatory, product marketing and sales management. Prior to co-founding ZyVersa, Mr. Glover was Co-Founder and Chief Business Officer of Coherus BioSciences, a late-stage commercial biologics platform Company focused on delivering biosimilar therapeutics which went public in 2014. Previously, he was President of Insmed Therapeutic Proteins and EVP and Chief Business Officer of Insmed Incorporated, where he was responsible for the creation of the Company’s biosimilar business unit and divestiture of that business to Merck and led the strategic review process that resulted in the merger of Insmed and Transave. Prior to joining Insmed, Mr. Glover held senior-level positions in sales, marketing and operations at Andrx Corporation, Roche Laboratories, Amgen and IMS Health. He currently serves as a Director of ZyVersa Therapeutics, Incon and Asclepius, as well as a BOD member of the Coulter Foundation as the University of Miami U Innovation Life Sciences Office. He holds a bachelor’s degree in Marketing from Illinois State University. Our Board of ContraFect Corporation (NASDAQ: CFRX), a biotechnology company; and Chairman of the Board of Aevi Genomic Medicine, Inc. (NASDAQ: GNMX), a genomic medicine company. Dr. Barer holds a B.S. from Brooklyn College. He earned his Ph.D. in Organic Chemistry from Rutgers University.

Sir Richard Sykes

Sir Richard Sykes has served on PDS’s board of directors since December 2014. He is currently Chairman of Imperial College Healthcare King Edward V11 Hospital, Chairman of the Royal Institution of Great Britain, Chairman of the UK Stem Cell Foundation, Chairman of Omnicyte and NetScientific. He was appointed Chancellor of Brunel University in 2013. Prior to that, he was Senior Independent Director and non-executive Chairman of ENRC from 2007 to June 2011, Chairman of NHS London from December 2008 to July 2010, Rector of Imperial College London from 2000 to 2008. He was a non-executive director of Rio Tinto plc from 1997 to 2007, and senior independent director from 2004 to 2007. He has over 30 years’ experience within the

8

biotechnology and pharmaceutical industries field, serving as Chief Executive and Chairman of GlaxoWellcome from 1995 to 2000 and then as Chairman of GlaxoSmithkline until 2002. Internationally he is Chairman of the International Advisory Board, A*Star Biomedical Research Council, Singapore and a Board member of EDBI. He was awarded Honorary Citizenship of Singapore in 2004 for his contribution to the development of the country’s biomedical sciences industry. Sir Richard holds a number of degrees and awards from Institutions both in the UK and overseas. He is a Fellow of the Royal Society and Academy of Medical Sciences, and an Honorary Fellow of the Royal Academy of Engineering, Royal Society of Chemistry, Royal Pharmaceutical Society, Royal College of Pathologists and the Royal College of Physicians. He is also President of the R and D Society, a position he has held since 2002. He is a Fellow of Imperial College London and the Imperial College School of Medicine, King’s College London and Honorary Fellow of the Universities of Wales and Central Lancashire. Sir Richard received a Knighthood in the 1994 New Year’s Honours list for services to the pharmaceutical industry. The board of directors believes that Sir Richard’s extensive leadership experience, experience in biopharmaceutical product development, deep understanding of pharmaceutical development, and broad experience within the biotechnology and pharmaceutical industries provide him with the qualifications and skills to serve as a director.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE IN FAVOR OF ITS NOMINEES.

9

CLASS B DIRECTORS CONTINUING IN OFFICE UNTIL THE 2020 ANNUAL MEETING

James J. Loughlin

Mr. Loughlin joined PDS’s board of directors following the merger with Edge Therapeutics in March 2019. He served on Edge’s board of directors since November of 2011. Since 2007, he has served on the boardsboard of Celgene Corporation (NASDAQ: CELG), where he is chair of the audit committee and a member of the compensation committee. Mr. Loughlin retired in 2003 after 40 years at KPMG LLP, a leading professional accounting and business consulting firm. As a partner at KPMG, he served for five years as a member of the board as well as National Director of the Pharmaceuticals Practice and as Chairman of the pension and investment committee of the KPMG Board from 1995 through 2001. Mr. Loughlin is a certified public accountant and received his B.S. degree in Accounting from St. Peter’s University in 1964. The board of directors believes Mr. Loughlin’s valuable experiences as national director of the pharmaceuticals practice at KPMG LLP, an extensive background in accounting and financial reporting, and prior service on the board of directors of other publicpublicly-held biopharmaceutical companies, provide him with the qualifications and skills to serve as a director.

Mr. Leuthner, one of our co-founders, has served on our board of directors andSaik has been our PresidentPDS’s Chief Financial Officer and CEOa director since our inception in January 2009. He has more than 28 yearsMarch 15th, 2019. Mr. Saik was most recently Chief Financial Officer at Edge Therapeutics, Inc., since October 2017 where he led the IR function and created a business development function to help grow the company. Mr. Saik managed the external messaging of experience in the biotechnologycompany and pharmaceutical marketplace, with a specific expertise in orphan products, critical care and neurocritical care. Mr. Leuthner has also worked in the hematology and oncology, infectious disease and cardiology marketplaces.helped prepare for commercialization of its primary asset. Prior to founding ourEdge Mr. Saik was CFO at Vertice Pharma, LLC, from August 2015 where he managed secured a $300 million commitment to fund acquisitions from a prominent private equity firm. Previously, he was Chief Financial Officer at Auxilium Pharmaceuticals, Inc., from August 2014 to April 2015, where he helped lead the execution of Auxilium’s growth strategy and executed a $75M cost reduction program, took out $50M accordion on Term Loan to ensure liquidity though restructuring and negotiated a definitive agreement to sell the company for $33.25 per share (up from $17.51) resulting in an 85% increase in share price in six months. From February 2013 to August 2014 Mr. LeuthnerSaik was Senior Vice President, Finance and Treasurer at Endo Health Solutions, Inc., where he was responsible for internal and external reporting, global consolidations of M&A transactions, cash management, debt financing and risk management. During his tenure at Endo, he helped complete the CEOacquisition of Fontus Pharmaceuticals, Inc. from 2007Paladin Labs and restructured $3B of debt into a new corporate structure. Prior to 2008, the Senior Head of Marketing for The Medicines Company (NASDAQ: MDCO) from 2005 to 2007 and the Director of Market Development for ESP Pharma, Inc. from 2003 to 2005. He also held marketing and sales positions of significantEndo, Mr. Saik served in senior financial management roles with increasing responsibility at Burroughs WellcomeValeant Pharmaceuticals International, including Senior Vice President, Finance and Company, Glaxo Wellcome plcCFO of the Specialty Pharmaceutics Business. At Valeant he also had operational responsibility for the $3B specialty pharmaceutical business where he actively managed the commercial, manufacturing, and Johnson & Johnson (NYSE: JNJ). Mr. Leuthner received his B.S.research and M.B.A. degreesdevelopment operations. He holds a Master of Business Administration from the University of North CarolinaSouthern California and a Bachelor of Arts from the University of California, Los Angeles. The Board of Directors believes that Mr. Saik’s perspective and experience as PDS’s Chief Financial Officer, as well as his depth of operating and senior management experience in the pharmaceuticals industry and educational background, provide him with the qualifications and abilities to serve as a director.

10

CLASS C DIRECTORS CONTINUING IN OFFICE UNTIL THE 2021 ANNUAL MEETING

Dr. Bedu-Addo, one of the founders of PDS, has served as a director, president, and CEO of PDS since its inception in 2005. Dr. Bedu-Addo is a veteran biotech executive with experience successfully starting and growing biotechnology organizations. He has been responsible for the development and implementation of both operational and drug development strategies, supervising and managing both large organizations and emerging biotechnology companies. Dr. Bedu-Addo was a founding and senior executive at Chapel Hill.

De Lyle W. Bloomquist

Mr. ContiBloomquist has served on ourPDS’s board of directorsDirectors since June 2010.December 2014. Mr. Conti is Chairman of The Conti Group, where he has beenBloomquist retired in March 2015 as the President, Global Chemicals Business for Tata Chemicals Ltd. as well as the President, CEO and President since 1995. The Conti Group, originally foundedDirector of Tata Chemicals North America Inc. (the former General Chemical Industrial Products Inc.), which he was instrumental in 1906, is a global developer and builder of capital asset projects. Under his guidance, The Conti Group has completedselling to Tata Chemicals for over $4$1 billion in projects2008. During his 28-year career, he held positions in 14 countriesfinance, manufacturing, sales & marketing, logistics and general management. He has experience in taking companies public and private, raising financing in the infrastructure, energy, industrial, environmentalpublic markets as well as with banks and security markets. An honors graduateprivate investors. Mr. Bloomquist serves on the Board of Directors for Rayonier Advanced Materials Inc. (NYSE: RYAM), Crystal Peak Minerals Inc. (TSXV: CPM), Gran Colombia Gold Corporation (TSX: GCM), PDS Biotechnology Corporation, Huber Engineered Materials, and Vivos Therapeutics Inc., and has served in Civil Engineering from Villanova University, Mr. Conti received the Collegepast on the Board of Engineering’s Alumni AwardDirectors of ANSAC, Oglebay Norton Corporation, a number of Tata Chemicals entities, and Costa Farms. He currently serves on the compensation and audit committees of RYAM; the technical, finance and audit committees of CPM; the audit committee of GCM; and the nomination and governance, and compensation committees of Vivos Therapeutics. He also serves on the Board of Business Advisors for Outstanding Leadership. He is a Harvard Universitythe Tepper School of Business School alumnus of the Owner/President Management Program and a recipient of Ernst & Young’s Entrepreneur of the Year award.

11

Management Following the Merger

In connection with the Merger, the Company’s board was fixed at seven members, four of whom were designated by Private PDS and three of whom were designated by Edge. The Edge designees were Andrew Saik, James J. Loughlin and Robert Spiegel, M.D.

Independence of the Board of Directors

As required under the Nasdaq listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. The Board consults with our counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

The Board has undertaken a review of the independence of our directors and has determined that all of our directors, except Frank Bedu-Addo, Ph.D. and Andrew Saik, are independent within the meaning of Section 5605(a)(2) of the Nasdaq Stock Market listing rules. Dr. Spiegel spent over 25 years at Schering-Plough Corporation, retiring in 2009 from his position asBedu-Addo is not an independent director under these rules because he is our President and Chief MedicalExecutive Officer, and Senior Vice PresidentMr. Saik is not an independent director under these rules because he is our Chief Financial Officer.

Board Leadership Structure

The Board has appointed Mr. Stephen Glover as Chairman of the Schering-Plough Research Institute. Dr. Spiegel servesBoard. The Chairman has the authority, among other things, to preside over Board meetings, to set meeting agendas and to perform all other duties delegated to him from time to time by the Board. We believe that separation of the positions of Board Chair and Chief Executive Officer reinforces the independence of the Board in its oversight of our business and affairs. In addition, we believe that having an independent Chairman creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in our best interests and the best interests of our stockholders. As a result, we believe that having an independent Chairman can enhance the effectiveness of the Board as a whole.

Role of the Board in Risk Oversight

One of the Board’s key functions is informed oversight of our risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for us. Our Audit Committee has the responsibility to review and discuss with management and KPMG LLP, the Company’s independent auditors, as appropriate, our guidelines and policies with respect to risk assessment and risk management, including our major financial risk exposures and the steps taken by management to monitor and control these exposures. Our Nominating and Corporate Governance Committee is responsible for developing our corporate governance principles, and periodically reviews these principles and their application. Our Compensation Committee reviews our practices and policies of employee compensation as they relate to risk management and risk-taking incentives, to determine whether such compensation policies and practices are reasonably likely to have a material adverse effect on us.

12

Meetings of the Board of Directors

Edge’s Board met ten (10) times and Private PDS’s Board met four (4) times during the year ended December 31, 2018. All directors attended at least 75% of the aggregate number of meetings of the Board and of the committees on which they served during 2018 or the portion thereof for which they were directors or committee members.

Information Regarding Committees of the Board of Directors

The Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership information as of the Record Date for each of these standing Board committees. From time to time, our Board and committees also take action by written consent without a meeting. Each of our Board committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities.

Name | Audit | Compensation | Nominating and Corporate Governance |

Stephen Glover | X | X* | |

Frank Bedu-Addo, Ph.D. | |||

Gregory Freitag, J.D., CPA | X | X | |

De Lyle W. Bloomquist | X* | ||

Sir Richard Sykes | X | X | |

Andrew Saik | |||

James J. Loughlin | X* | X |

| * | Committee Chairperson |

Audit Committee

Our Audit Committee currently consists of Mr. Freitag, Mr. Glover and Mr. Loughlin, each of whom satisfies the independence requirements under The Nasdaq Capital Market listing standards and Rule 10A-3(b)(1) of the Exchange Act. The chairperson of our Audit Committee is Mr. Loughlin, whom our Board has determined to be an “audit committee financial expert” within the meaning of SEC regulations. Each member of our Audit Committee can read and understand fundamental financial statements in accordance with Audit Committee requirements. In arriving at this determination, the Board has examined each Audit Committee member’s scope of experience and the nature of their employment in the corporate finance sector. Edge’s Audit Committee held seven (7) meetings in 2018.

The primary purpose of our Audit Committee is to assist the Board in the oversight of the integrity of our accounting and financial reporting process, the audits of our financial statements, and our compliance with legal and regulatory requirements. The functions of our Audit Committee include, among other things:

13

With respect to reviewing and approving related-party transactions, our Audit Committee reviews related-party transactions for potential conflicts of interests or other improprieties. Under SEC rules, related-party transactions are those transactions to which we are or may be a party in which the amount involved exceeds $120,000, and in which any of our directors or executive officers or any other related person had or will have a direct or indirect material interest, excluding, among other things, compensation arrangements with respect to employment and board membership. Our Audit Committee could approve a related-party transaction if it determines that the transaction is in our best interests. Our directors are required to disclose to the committee or the full Board any potential conflict of interest or personal interest in a transaction that our board is considering. Our executive officers are required to disclose any potential conflict of interest or personal interest in a transaction to the Audit Committee. We also poll our directors and executive officers on an annual basis with respect to related-party transactions and their service as an officer or director of other entities. Whenever possible, the transaction should be approved in advance and if not approved in advance, must be submitted for ratification as promptly as practical.

The Board has adopted a charter for the Audit Committee that complies with SEC and Nasdaq Stock Market listing rules. The charter is available on our website at www.pdsbiotech.com.

Compensation Committee

Our Compensation Committee currently consists of Mr. Glover, Mr. Loughlin, and Sir Richard Sykes, each of whom our Board has determined to be independent under the Nasdaq listing standards, a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act, and an “outside director” as that term is defined in Section 162(m) of the Internal Revenue Code. The chairperson of our Compensation Committee is Stephen Glover. Edge’s Compensation Committee held four (4) meetings in 2018.

The primary purpose of our Compensation Committee is to assist the Board in exercising its responsibilities relating to compensation of our executive officers and employees and to administer our equity compensation and other benefit plans. In carrying out these responsibilities, this committee reviews all components of executive officer and employee compensation for consistency with its compensation philosophy, as in effect from time to time. The functions of our Compensation Committee include, among other things:

The Board has adopted a charter for the Compensation Committee that complies with SEC and Nasdaq Stock Market listing rules. The charter is available on our website at www.pdsbiotech.com.

14

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee has ever been an executive officer or employee of ours. None of our officers currently serve, or served during 2018, on the compensation committee or board of directors of any other entity that has one or more officers serving as a member of the Board or Compensation Committee.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee currently consists of Mr. Bloomquist, Mr. Freitag and Sir Richard Sykes, each of whom our Board has determined to be independent under the Nasdaq listing standards. The chairperson of our Nominating and Corporate Governance Committee is Mr. Bloomquist. Edge’s Nominating and Corporate Governance Committee held two (2) meetings in 2018.

The primary purpose of our Nominating and Corporate Governance Committee is to assist the Board in promoting our best interests and the best interests of our stockholders through the implementation of sound corporate governance principles and practices. The functions of our Nominating and Corporate Governance Committee include, among other things:

The Board has adopted a charter for the Nominating and Corporate Governance Committee that complies with SEC and Nasdaq Stock Market listing rules. The charter is available on our website at www.pdsbiotech.com.

While the Nominating and Corporate Governance Committee does not have a formal diversity policy, the Nominating and Corporate Governance Committee recommends candidates based upon many factors, including the diversity of Geron Corporation (NASDAQ: GERN),their business or professional experience, the diversity of their background and their array of talents and perspectives. We believe that the Nominating and Corporate Governance Committee’s existing nominations process is designed to identify the best possible nominees for the Board, regardless of the nominee’s gender, racial background, religion, or ethnicity. The Nominating and Corporate Governance Committee identifies candidates through a biotechnology oncology company, where he also servesvariety of means, including recommendations from members of the Board and suggestions from our management, including our executive officers. In addition, the Nominating and Corporate Governance Committee considers candidates recommended by third parties, including stockholders. The Nominating and Corporate Governance Committee gives the same consideration to candidates recommended by stockholders as those candidates recommended by members of our Board. Nominees should have a reputation for integrity, honesty and adherence to high ethical standards, should have demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to our current and long-term objectives, should be willing and able to contribute positively to our decision-making process, should have a commitment to understand PDS and our industry and to regularly attend and participate in meetings of the Board and its committees, should have the interest and ability to understand the sometimes conflicting interests of the various constituencies of PDS, which include stockholders, employees, customers, creditors and the general public, and to act in the interests of all stockholders, should not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all our stockholders and to fulfill the responsibilities of a director. Nominees shall not be discriminated against on the compensation committee. He currently serves as Chairmanbasis of Vidac Pharma andrace, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law. The value of diversity on the Board of Neximmune, private biotechnology companies. Heshould be considered.

The Nominating and Corporate Governance Committee considers director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the criteria set forth above, based on whether or not the candidate was previouslyrecommended by a director of Talon Therapeutics, Inc.,stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a biopharmaceutical oncology company, where he also served onwritten recommendation to the audit committee,Nominating and Sucampo Pharmaceuticals where he served on the compensation and nominating and governance committees and Clavis Pharma ASA, a pharmaceutical company based in Oslo, Norway. Dr. Spiegel holds a B.A. from Yale University and an M.D. from the University of Pennsylvania. Following a residency in internal medicine, he completed a fellowship in medical oncologyCorporate Governance Committee at the National Cancer Institutefollowing

15

address: PDS Biotechnology Corporation, Attn: Corporate Secretary at 300 Connell Drive, Suite 4000, Berkeley Heights, NJ 07922 no earlier than the close of business on June 26, 2020, and held academic positions atno later than the National Cancer Instituteclose of business on July 26, 2020. Submissions must be made in accordance with our bylaws and New York University Medical Center.

Stockholder Communications with the Board of Directors

We do not have a formal process related to stockholder communications with the Board. However, we strive to ensure that the views of stockholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. We believe our responsiveness to stockholder communications to the Board has been excellent. If you wish to send a communication to the Board, its chair or the chair of any Board committee, please send your communication to Andrew Saik, our Chief Financial Officer, at PDS Biotechnology Corporation at 300 Connell Drive, Suite 4000, Berkeley Heights, NJ 07922, who will forward all appropriate communications as requested.

Code of Business Conduct and Ethics for Employees, Executive Officers and Directors

We have adopted a Code of Conduct, applicable to all of our employees, executive officers and directors. The Code of Conduct is available on our website at www.pdsbiotech.com. The Nominating and Corporate Governance Committee is responsible for overseeing the Code of Conduct and must approve any waivers of the Code of Conduct for employees, executive officers or directors. We expect that any amendments to the Code of Conduct, or any waivers of its requirements, will be disclosed on our website.

Director Compensation

Edge Director Compensation

Edge’s historical compensation policy for its directors prior to the completion of the Merger is set forth below. Please see the section entitled “Director Compensation Policy Following the Merger” for the Company’s current director compensation policy.

Under Edge’s formal non-employee director compensation plan, commencing on October 1, 2017 and running through June 30, 2018, Edge paid each non-employee director a cash retainer covering such period in the amount of $26,250 ($35,000 on an annualized basis), payable in three equal quarterly installments in arrears on the last day of the fiscal quarter in which such service occurred. Edge paid additional cash retainers on the same schedule to (i) the chair of the Board in the amount of $22,500 ($30,000 annualized), (ii) the chair of the Audit Committee in the amount of $11,250 ($15,000 annualized), (iii) the chair of the Compensation Committee in the amount of $9,000 ($12,000 annualized), (iv) the chair of the Nominating and Corporate Governance Committee in the amount of $6,000 ($8,000 annualized), (v) each other member of the Audit Committee in the amount of $6,000 ($8,000 annualized), (vi) each other member of the Compensation Committee in the amount of $5,250 ($7,000 annualized) and (vii) each other member of the Nominating and Corporate Governance Committee in the amount of $3,000 ($4,000 annualized).

Further, commencing on July 1, 2018 and running through the closing of the Merger, Edge paid each non-employee director an annual cash retainer in the amount of $40,000, payable in equal, quarterly installments in arrears on the last day of the fiscal quarter in which such service occurred. The additional annual cash retainers that Edge provided during such period were paid on the same schedule to (i) the chair of the Board in the amount of $30,000, (ii) the chair of the Audit Committee in the amount of $18,500, (iii) the chair of the Compensation Committee in the amount of $15,000, (iv) the chair of the Nominating and Corporate Governance Committee in the amount of $8,000, (v) each other member of the Audit Committee in the amount of $8,000, (vi) each other member of the Compensation Committee in the amount of $7,000, and (vii) each other member of the Nominating and Corporate Governance Committee in the amount of $4,500.

16

In addition to the payment of annual cash retainers, Edge’s compensation plan provided for grants of options to purchase shares of Edge common stock to non-employee directors pursuant to the terms and conditions of Edge’s 2014 Amended and Restated Equity Incentive Plan (the “2014 Plan”). Under the plan, each non-employee new director was granted an option covering 1,500 shares of Edge common stock on the date of his or her initial election to the Board. These options vested 1⁄3 on the one year anniversary of the grant date, 1/3 on the two year anniversary of the grant date and 1⁄3 on the three year anniversary of the grant date, in all cases subject to the non-employee director’s continuing service on the Board. Each continuing non-employee director of Edge, other than the Chairman of the Edge Board, was granted an option covering 750 shares of Edge common stock on the date of the Edge 2018 annual meeting of stockholder (the “2018 Annual Meeting”). These options vested fully on the one year anniversary of the grant date, subject to the non-employee director’s continuing service on the Edge Board. The Chairman of the Edge Board was granted an option covering 1,500 shares of Edge common stock on the date of the 2018 Annual Meeting. These options vested fully on the one year anniversary of the grant date, subject to the Chairman of the Edge Board continuing service on the Edge Board.

The table below summarizes the compensation paid by Edge to each non-employee director for the year ended December 31, 2018:

Name | Fees Earned Or Paid in Cash ($) | Option Awards ($)(1) | Total ($) | ||||||

Sol Barer, Ph.D. | 92,500 | 40,175 | 132,675 | ||||||

Isaac Blech | 20,088 | 61,838 | |||||||

Kurt Conti(2) | 21,500 | — | 21,500 | ||||||

Rosemary Crane | 51,750 | 20,088 | 71,838 | ||||||

James I. Healy, M.D., Ph.D.(3) | 21,500 | — | 21,500 | ||||||

James J. Loughlin | 54,250 | 20,088 | 74,338 | ||||||

Liam Ratcliffe, M.D., Ph.D. | 44,500 | 20,088 | 64,588 | ||||||

Robert Spiegel, M.D. | 69,250 | 20,088 | 89,338 | ||||||

| (1) | The amounts shown in this column do not reflect actual compensation received by our directors. The amounts reflect the grant date fair value of |

| (2) | Mr. Conti resigned from the Edge Board on June 19, 2018. |

| (3) | Mr. Healy ceased to serve |

The aggregate number of options held by the Edge non-employee directors on December 31, 2018 was as follows:

Name | Number of Options | ||

Sol Barer, Ph.D. | 36,041 | ||

Isaac Blech | 41,447 | ||

Rosemary Crane | |||

James J. Loughlin | |||

3,750 | |||

Robert Spiegel, M.D. | |||

17

Private PDS Director Compensation

Prior to the completion of the Merger, the Private PDS board of directors was comprised of 5 members, Frank Bedu-Addo, Ph.D., Ian Postlethwaite, Gregory Freitag, J.D., CPA, De Lyle W. Bloomquist and Sir Richard Sykes. Each member of the Private PDS board currently serves as a member of the Company’s Board except for Mr. Postlethwaite who resigned as a director of Private PDS in connection with the Merger in March 2019.

Private PDS did not adopt a formal non-employee director compensation plan. In October 2018, the Private PDS Board of Directors agreed to grant each of Ian Postlethwaite and Sir Richard Sykes, each directors of Private PDS, shares of Private PDS common stock in lieu of cash compensation for advisory services. The Private PDS Board of Directors also agreed to grant each of Mr. Bloomquist and Mr. Freitag, each directors of Private PDS, options to purchase shares of Private PDS common stock in lieu of cash compensation for advisory services.

Director Compensation Policy Following the Merger

On June 28, 2019, we adopted a director compensation policy based on Edge’s existing director compensation program. Pursuant to the policy, the annual retainer for non-employee directors is $40,000 and the annual retainer for the chair of the board of directors is $70,000. Annual retainers for committee membership are as follows:

Committee | Annual Retainer | ||

Audit Committee Chairperson | $ | 18,500 | |

Audit Committee Member | $ | 8,000 | |

Compensation Committee Chairperson | $ | 15,000 | |

Compensation Committee Member | $ | 7,500 | |

Nominating and Corporate Governance Committee Chairperson | $ | 8,000 | |

Nominating and Corporate Governance Committee Member | $ | 4,000 | |

These fees are payable in arrears in four equal quarterly installments on the last day of each quarter, provided that the amount of such payment will be prorated for any portion of such quarter that a director is not serving on our board of directors, on such committee or in such position. Non-employee directors are also reimbursed for reasonable out-of-pocket business expenses incurred in connection with attending meetings of the board of directors and any committee of the board of directors on which they serve and in connection with other business related to the board of directors. Directors may also be reimbursed for reasonable out-of-pocket business expenses authorized by the board of directors or a committee that are incurred in connection with attending conferences or meetings with management in accordance with a travel policy, as may be in effect from time to time.

In addition to the above fees, the board of directors may determine that additional committee fees are appropriate and should be payable for any newly created committee of the board of directors.

In addition, we grant to new non-employee directors upon their initial election to the board of directors, an option to purchase 9,000 shares of our common stock at an exercise price equal to the closing price of our common stock on the date of grant. Each of these options has a term of 10 years from the date of the award and 1/3 of the these options vest upon each of the first, second and third anniversaries of the date of grant, subject to the non-employee director’s continued service as a director. This vesting accelerates as to 100% of the shares upon a change in control of the Company.

Further, on the dates of each of our annual meetings of stockholders, with the exception of this year’s Annual Meeting, each non-employee director that has served on our board of directors for at least six months automatically receives an option to purchase 9,000 shares of our common stock at an exercise price equal to the closing price of our common stock on the date of the grant and each non-employee director that has served on our board of directors for less than six months shall receive a pro rata share of such options. Each of these options has a term of 10 years from the date of the award and 1/3 of the these options vest upon each of the first, second and third anniversaries of the date of grant, subject to the non-employee director’s continued service as a director, with 100% acceleration of vesting upon a change in control of the Company.

18

The following table sets forth information regarding our executive officers as of the Record Date.

Name | Position | |

54 | ||

Andrew Saik | 50 | Chief Financial Officer and Director |

Gregory L. Conn, Ph.D. | 64 | Chief Scientific |

Lauren Wood, M.D. | Chief Medical Officer |

Biographies for each of our executive officers is provided below.

Frank Bedu-Addo, Ph.D.

Please see Dr. Bedu-Addo’s biography on page 11 of this proxy statement under the section “Class C Directors Continuing in Office Until the 2020 Annual Meeting.”

Andrew Saik

Please see Mr. Saik’s biography on page 10 of this proxy statement under the section “Class B Directors Continuing in Office Until the 2020 Annual Meeting.”

Gregory L. Conn, Ph.D.

Dr. Conn was a founding member of the PDS team in 2005 as Chief Scientific Officer and continues to serve PDS in that role. He has more than 35 years of drug-development expertise, including development of antiviral and anticancer drugs through to commercialization. He is a graduate of the Albert Einstein College of Medicine, where he obtained both his M.S. and Ph.D., discovering novel angiogenic molecules in the human brain. Dr. Conn started his pharmaceutical career at Merck, Sharpe, and Dohme, where he continued his work on novel angiogenic factors, discovering and characterizing the VEGF family of growth factors, work which led to the development and commercialization of the anti-cancer drug Avastin. He was later a leading scientist at Regeneron Pharmaceuticals, where he established and headed various groups in the Cell and Molecular Biology and Drug Discovery departments. Dr. Conn subsequently became a Director in the Process Development department at Covance Biotechnology Services Inc., a contract research and development and drug manufacturing organization, where he supervised the analytical development teams responsible for drug characterization, method development and drug stability studies, and program teams responsible for developing drug manufacturing processes. Dr. Conn has expertise across all phases of the drug development process, including FDA and regulatory requirements, is the co-inventor of eight drug patents.

Lauren Wood, M.D.

Dr. Wood has served as Chief Medical Officer of PDS since March 2019. Dr. Wood previously served as the Head of the Vaccine Branch Clinical Trials Team for the National Cancer Institute Center for Cancer Research from 2005 until 2017, where she was charged with developing a clinical translational research program to develop vaccines and immune-based therapies that harness the immune response to control, eradicate or prevent cancer and HPV. Prior to that, Dr. Wood served as a member of the senior staff of the National Cancer Institute Pediatric HIV Working Group from 1996 to 2005. Dr. Wood completed a combined residence in internal medicine and pediatrics at Baylor College of Medicine Affiliated Hospitals in Houston, Texas and a fellowship with the National Institute of Allergy and Infectious Diseases in allergy and immunology. Dr. Wood obtained a B.A. in Biology from Oberlin College and an M.D. from Duke University School of Medicine.

19

Set forth below is certain information regarding the historical compensation of certain Edge executive officers prior to the completion of the Merger, which we are required by SEC rules to present in this proxy statement. In addition, set forth below is also certain information regarding the historical compensation of certain Private PDS executive officers prior to completion of the Merger, and certain arrangements we have made with certain of our executive officers following the completion of the Merger, both of which we are voluntarily providing.

Edge Executive Compensation

2018 Summary Compensation Table

The following table sets forth information for the years ended December 31, 2017 and December 31, 2018 concerning compensation of (i) Edge’s principal executive officers, (ii) Edge’s most highly compensated executive officers, other than Edge’s principal executive officer, who were serving as executive officers of Edge as of December 31, 2018 and (iii) up to two additional individuals for whom disclosure would have been made available in this table but for the fact that the individual was not serving as an officer of Edge on December 31, 2018. We refer to these executives as the Edge named executive officers.

Name and Principal Position | Year | Salary ($) | Bonus ($) | Option Awards(1) ($) | Restricted Stock Units(6) ($) | All Other Compensation(2) ($) | Total ($) | ||||||||||||

Brian A. Leuthner Chief Executive Officer(4) | 2018 | 530,000 | 318,000 | 3,356,300 | 143,846 | 7,488 | 4,355,634 | ||||||||||||

2017 | 500,000 | 255,000 | 1,761,831 | — | 10,800 | 2,527,631 | |||||||||||||

R. Loch Macdonald, M.D., Ph.D. Chief Scientific Officer(3) | 2018 | 150,750 | — | 11,578 | 8,510 | 272,179 | 443,017 | ||||||||||||

2017 | 402,000 | 153,765 | 724,493 | — | 10,800 | 1,291,059 | |||||||||||||

Herbert J. Faleck Chief Medical Officer(4) | 2018 | 416,000 | 187,200 | 646,945 | 50,918 | 11,000 | 1,312,063 | ||||||||||||

2017 | 400,000 | 153,000 | 724,493 | — | 10,800 | 1,288,293 | |||||||||||||

Andrew Saik Chief Financial Officer | 2018 | 370,000 | 166,500 | 660,490 | 70,632 | — | 1,267,622 | ||||||||||||

2017 | 61,667 | — | 1,594,402 | — | — | 1,656,069 | |||||||||||||

W. Bradford Middlekauff SVP, General Counsel and Secretary | 2018 | 347,700 | 157,470 | 791,426 | 42,351 | 11,000 | 1,349,947 | ||||||||||||

2017 | 328,000 | 97,580 | 345,782 | — | 10,800 | 782,162 | |||||||||||||

| (1) | Amounts shown in this column do not reflect actual compensation received by the

2018. The | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | Amounts shown in this column reflect Edge’s matching contributions to Edge’s 401(k) plan. For Dr. Macdonald, the amount shown in this column includes 401K plan contribution of $6,110 and the dollar value of severance benefits paid through December 31, 2018, which is comprised of continuation of Dr. Macdonald’s base salary ($251,250) and reimbursements of amounts paid for health care continuation under COBRA for Dr. Macdonald and his eligible dependents ($14,819). |

| (3) | Dr. Macdonald ceased employment with Edge on May 15, 2018. |

| (4) | Dr. Faleck ceased employment with Edge on December 31, |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (6) | All outstanding Restricted Stock Units (RSUs) vested and converted into shares of |

Narrative to Summary Compensation Table

Employment Agreements

Edge entered into employment agreements with each of the named executive officers.

Other than with respect to Dr. Macdonald, whose employment with Edge terminated on May 15, 2018, Dr. Faleck, whose employment with Edge terminated on December 31, 2018, and Mr. Leuthner whose employment with Edge terminated on March 15, 2019 in connection with the Merger, the term of employment for each Edge named executive officer under his employment agreement continued until the executive’s

20

employment with Edge terminated for any reason. Each employment agreement sets forth the Edge named executive officer’s annual base salary and target bonus opportunity, and the Edge named executive officer’s right to participate in Edge’s health insurance program and other benefit programs provided to Edge executives generally. Under the terms of these agreements, the Edge named executive officers’ base salaries were subject to annual review and adjustment by the Edge Board. The base salaries for 2017 and 2018 for each of Edge’s named executive officers are reflected in the table above.

Each Edge employment agreement also provided for additional payments and benefits to be made in connection with the Edge named executive officer’s termination of employment, as described below. In addition, in connection with their employment, each Edge named executive officer entered into Edge’s standard confidentiality and invention assignment agreement, which set forth duties of confidentiality and certain intellectual property rights between Edge and Edge’s employees. Each Edge executive employment agreement also provided that equity and incentive compensation is subject to any clawback policy of Edge in effect from time to time, or otherwise required by law or applicable stock exchange.

2017 and 2018 Annual Cash Incentive Compensation

Expressed as a percentage of base salary, the target bonus opportunity for Mr. Leuthner, Dr. Macdonald, Dr. Faleck and Mr. Middlekauff in 2017 was 60%, 45%, 45% and 35%. The ultimate determinations of cash bonuses for the Edge named executive officers are based on the achievement of corporate goals, provided that the Edge Compensation Committee and, for Mr. Leuthner, the Edge Board, retain discretion to award a higher or lower bonus than warranted based on the achievement of the corporate goals. These goals were reviewed and approved by the Edge Compensation Committee and the Edge Board at the beginning of each year. At or after the end of such year, the Edge Compensation Committee determined the extent to which these corporate goals had been attained and, based on such determination, the Edge Compensation Committee thereafter approved the annual cash bonus to be awarded. For 2017, the Edge corporate goal categories (and weighting) were as follows: financial goals (15%); clinical/ medical affairs goals (25%); regulatory goals (20%); manufacturing goals (15%); research goals (12%); commercial goals (5%) and corporate goals (8%). After reviewing performance for 2017, the Edge Compensation Committee determined that the performance goals were achieved at 85% of target. The bonus earned by Mr. Leuthner, Dr. Macdonald, Dr. Faleck and Mr. Middlekauff for 2017 is listed in the “Nonequity Incentive Plan Compensation” column in the 2018 Summary Compensation Table above. Mr. Saik was not eligible for any bonus opportunity in 2017 following his hiring on October 31, 2017.

The named executive officers of Edge were not entitled to cash bonus compensation for 2018. However, the named executive officers of Edge other than Dr. Macdonald entered into certain retention arrangements described below in the section titled “Certain Relationships and Related-Party Transactions” under the header “Retention Arrangements.”

Equity Incentive Compensation - Option Awards

On November 3, 2014, Edge stockholders approved the Amended and Restated Edge Therapeutics, Inc. 2014 Equity Incentive Plan, or the Edge Plan. The Edge Plan was the primary program through which Edge granted equity-based incentive compensation to its employees and Edge’s directors. Under the Edge Plan, Edge may grant awards of restricted stock, options, stock appreciation rights, restricted stock units (“RSUs”) and other types of equity-based awards, in each case, with respect to Edge common stock.

Other than the stock options granted in connection with the Retention Arrangements (as described below in the section titled “Certain Relationships and Related Party-Transactions” under the header “Retention Arrangements”), all of the outstanding options granted to Edge’s named executive officers were subject to time-based vesting, such that options vested with respect to one-fourth of the underlying shares on the first anniversary of the grant date and in equal installments of 1⁄48 of the underlying shares thereafter for the subsequent 36 months. Under the employment agreements of Edge’s named executive officers, all equity awards will become 100% vested upon a change in control. However, during 2016, the Edge Compensation Committee reviewed the practice of “single trigger” vesting under Edge’s named executive officers’ employment agreements. In light of such review, the Edge Compensation Committee decided to use a new form of option award for Edge’s executives that eliminates automatic vesting on a change in control, and instead uses “double trigger” vesting (i.e., vesting does not automatically occur upon a change in control). This new vesting provision was adopted after Edge made stock option grants to Edge’s named executive officers in 2016, so none of their

21

2016 stock options contain double trigger vesting. However, the stock options granted to Edge’s named executive officers in March 2017 contained double trigger vesting in connection with a change in control, and the double trigger vesting feature supersedes the provisions in Edge’s named executive officers’ employment agreements that specify single trigger vesting upon a change in control. While the Edge Compensation Committee intended to use a “double trigger” vesting approach for new option awards granted to Edge’s named executive officers, it continued to analyze each separate option award to determine whether double trigger vesting was appropriate. Further, where double trigger vesting was utilized, Edge intended for the double trigger vesting feature to supersede any provision in Edge’s named executive officers’ employment agreements that specified single trigger vesting with respect to future stock option awards. The stock option awards granted to Edge’s named executed officers under the Edge Plan during 2018, including their vesting terms, are set forth in the Outstanding Equity Awards at Year-End table below.

Outstanding Equity Awards at Year-End

The table below sets forth the number of securities underlying outstanding plan awards for each Edge named executive officer as of December 31, 2018.

Name | Number of Securities Underlying Unexercised Options Exercisable | Number of Securities Underlying Unexercised Options Unexercisable | Option Exercise Price | Grant Date | Expiration Date | Number of Restricted Stock Award Shares that have not Vested | Market Value of Restricted Stock Award Shares that have not Vested | ||||||||||